No Hassle Coverage

Non-Medical

UNDERSTANDING tHE PROCESS

What You should Know

What happens when you apply for coverage

When you apply for life insurance, you go through the underwriting process. This includes a medical exam, an Attending Physician Statement, a background check with the Medical Information Bureau, and a prescription and motor vehicle report check. This is known as fully underwritten life insurance because it goes through the entire underwriting process.While the insurance company handles most of the process, the medical exam (also called the paramedical exam) requires your involvement. It’s like a basic health physical; you’ll have to provide a blood and urine sample, the technician will take your blood pressure, and they’ll determine your height and weight.

Why Insurance companies check YOUR Health

The cost of life insurance is largely dependent on your health; the more unhealthy you are the riskier you are to insure, and the more you’ll pay for your policy. By combining all of the above steps, life insurance companies can get a complete picture of your medical history and risk.But there are ways to get a life insurance policy without taking the medical exam. Sometimes it’s because the insurance company is using new techniques and data sources to replace the medical exam, or it might be because you’re paying higher premiums to offset the greater risk the insurance company takes on by not getting a full look at your health.

OUR EXPERIENCED AGENTS ARE AVAILABLE tO ASSIST WITH QUOTES AND ANSWER QUESTIONS

Things to consider

Do I need term or whole life insurance?

This is a question every shopper has to ask. Term life policies expire after a certain number of years, while whole life insurance stays active as long as you pay premiums. Both come with no exam options. See our full guide on term vs whole life insurance.

How much more expensive is no medical exam life insurance?

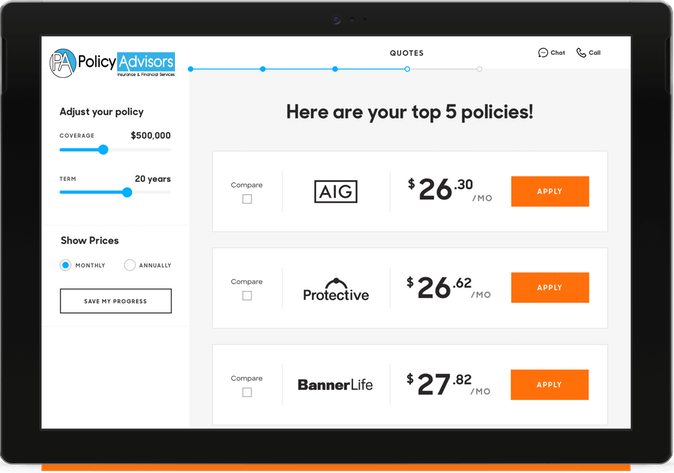

This depends on the type of policy you get. It may be virtually the same price as a fully underwritten policy, or it may be considerably more expensive because it’s targeted to unhealthy individuals. Always compare life insurance quotes to see if a no medical policy is more expensive than a fully underwritten policy.

How much life insurance can you get with no medical exam policies?

Because there may be increased risk for the life insurance company, there may be limits on how much coverage you can get. That means no medical exam policies can work well for low coverage amounts, but applicants looking for a large financial safety net may have to take the paramedical exam.

Which life insurance companies sell no medical exam policies?

Not every carrier will sell no exam policies. Get free quotes to compare policies yourself, talk to an expert to find out which one is right for you, or take a look at our life insurance company reviews to see which policies are offered by which carriers. (We can help you with all of the above. You can get started by comparing life insurance quotes across companies and talking to a licensed expert.)

wE ARE HERE TO PROTECT YOU

- 85% 0f American consumers agree that they need insurance, yet 62% do not have any or not enough. We would like to bridge this gap.

- 83% of American consumers say they didn’t purchase life insurances because they thought it’s too expensive.

- 70% of US households with children under 18 would have trouble meeting living expenses after a sudden untimely death.

Our Agents are Waiting to Help you with your Coverage

Request a quote or Ask Questions

- 866.978.9477

- [email protected]