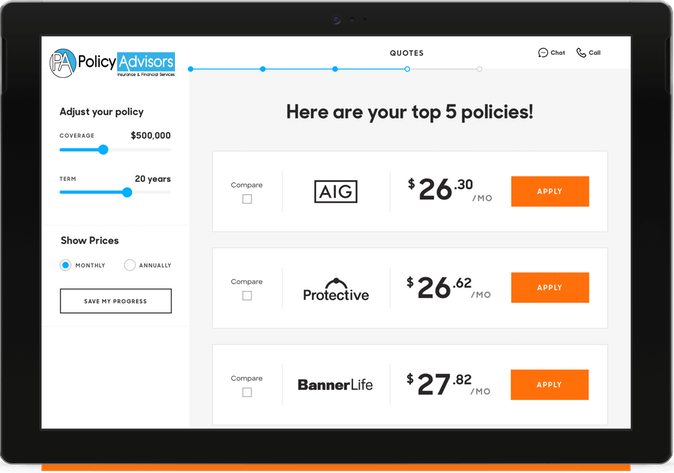

Compare your options with

Permanent Life

UNDERSTANDING PERMANENT LIFE INSURANCE

What You should Know

cOVERAGEwill never expire

Unlike term life insurance, Permanent life insurance also known as Whole life do not have a set “term” of coverage, but rather they last indefinitely. whole life provides lifelong coverage and includes an investment component known as the policy’s “cash value”.

More complicated than term

The premium remains the same for as long as you live, the death benefit is guaranteed, and the cash value account grows at a guaranteed rate. More complicated forms of permanent coverage may provide flexible premiums.

Builds Cash value

The cash value grows slowly, tax-deferred, meaning that you won’t pay taxes on its gains while they’re accumulating. You can borrow money against the account or surrender the policy for the cash. But if you don’t repay policy loans with interest, you will reduce your death benefit,

financial benifits

Some whole life policies are also eligible to earn annual dividends, a portion of the insurer’s financial surplus. You can take the dividends in cash, leave them on deposit to earn interest or use them to decrease your premium, repay policy loans or buy additional coverage.

OUR EXPERIENCED AGENTS ARE AVAILABLE tO ASSIST WITH QUOTES AND ANSWER QUESTIONS

PERMANENT lIFE iNSURANCE SIMPLIFIED

hOW IT WORKS

Whole Life is designed to last you your whole life (hence the name Whole Life). Whole Life is considered Permanent insurance (as opposed to Term insurance) Is Whole Life right for you?

For a conservative client that wants guarantees, Whole Life can be a great solution. Whole Life illustrations show the Guaranteed Cash Value Accumulation, but they also illustrate an expected, non-guaranteed cash value accumulation projection. Whole Life policies tend to accumulate cash value at an accelerated rate towards the end because the mortality rate that Whole Life policies use is fixed and level (as opposed to UL policies that have an increasing mortality rate as time goes on).

Whole Life offers guarantees in regards to the death benefit and cash values.

Whole Life doesn’t allow the client to participate in market growth the way that IUL does. It also requires the client to pay annual premiums with no flexibility (they cannot skip premium payments in the same way that a UL/IUL/VUL product allows).

UL provides the largest permanent death benefit for the least amount of premium but does not provide much cash value because it’s designed to have the majority of premium geared towards the death benefit (as opposed to cash value accumulation). UL is considered Permanent insurance (as opposed to Term insurance).

Someone who is not as concerned about building cash value accumulation for retirement, and wants a permanent policy for the death benefit only, UL is the is a viable option. For example, if an individual needs a policy to pay for the estate taxes that his/her heirs will be responsible for, UL could be a good solution. Often times, a UL policy will placed inside an Irrevocable Life Insurance Trust (ILIT) for the purpose of covering the heir’s estate tax liability.

UL has the cheapest premium for a permanent life insurance policy. It also allows flexible premium payments, so if the insured has a bad month or two regarding personal cash flow, they can get away with skipping a few payments.

The cash value accumulation in a UL policy is tied bond rates (interest rates). If the interest rates are up, the cash value in a UL policy will be up. However, if interest rates are down, the mortality rates (Cost Of Insurance) may outpace the interest rates, causing the mortality charges to eat up the cash value. In addition, the Cost Of Insurance (COI) increases over time, eating up the cash value in the policy, potentially putting the policy in danger of lapsing. However, a No Lapse Guarantee (NLG) rider can be added to the policy (at an additional cost) to prevent this from happening.

IUL is a type of Universal Life policy that has a significant amount of the premium applied to the investment side of the policy (as opposed to a standard UL policy that has the majority of the premium applied to the death benefit). The cash value accumulation is tied to a particular index (i.e.: S&P 500, EuroStoxx, Hang Seng, etc.) IUL is considered Permanent insurance (as opposed to Term insurance).

Someone who is interested in building a significant amount of cash value accumulation for retirement, and wants to take advantage of the potential upside of the market, IUL is a viable option. IUL policies have a floor and a ceiling, In other words, if the stock market goes down 40 points in a given year (like it did in 2008), this policy would earn a 0% return for the client (they wouldn’t lose 40% like they would have if they were in the stock market). Likewise, if the market went up 40 points, the most they could earn would be 12% for example.

In theory, the policy could lapse if the market melts down year after year for an extended period of time. If the client wants guarantees, perhaps Whole Life could be a better option.

IUL allows the client to participate in market growth, while at the same time limiting market losses.

VUL is a type of Universal Life policy that allows the client to, in a sense, be their own stockbroker. The client manages the investment portfolio inside their policy. Typically, VUL is generally not a very viable option because the investment fund fees are too high (compared to the IUL policies). VUL is considered Permanent insurance (as opposed to Term insurance).

Someone that wants to be their own stockbroker and manage their investments within their policy, VUL could be an option. However as stated above, the IUL policies typically make more financial sense for the client.

VUL gives the client control over their investments, plus the policy’s Cash Value increase has an unlimited upside (based on how the investments inside the policy perform).

It’s a difficult policy to manage, and the client has unlimited downside risk. If the Cash Value accumulation is too severely damaged by a series of bad market years (or in some cases, just ONE bad year), the policy can lapse ahead of schedule. In the past few years, we have seen literally hundreds of these types of policies scheduled to lapse prior to the policy expiration date..

wE ARE HERE TO PROTECT YOU

- 85% 0f American consumers agree that they need insurance, yet 62% do not have any or not enough. We would like to bridge this gap.

- 83% of American consumers say they didn’t purchase life insurances because they thought it’s too expensive.

- 70% of US households with children under 18 would have trouble meeting living expenses after a sudden untimely death.

Our Agents are Waiting to Help you with your Coverage

Request a quote or Ask Questions

- 866.978.9477

- [email protected]