Compare, Buy, and Learn About

Term Life Insurance

tERM lIFE iNSURANCE SIMPLIFIED

hOW IT WORKS

Calculate

Find the right amount of coverage with our life insurance calculator. No more, no less.

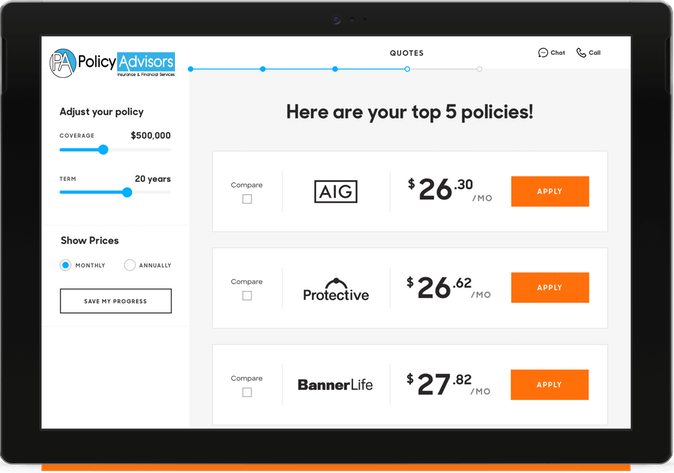

Compare

See the most affordable quotes from more than a dozen term life insurance companies side by side

Apply

Apply online and have access to our expert team every step of the way.

Helpful Information on term

Term life insurance is a form of life insurance that lasts for a set number of years — known as the term — before expiring. If you die before the term is up, your beneficiary — usually your family — receives a death benefit, usually as a tax-free lump sum of money that can be used for funeral expenses, to pay bills, or for any other use.

Term life insurance is one of the most popular ways to create a financial safety net. Money experts like Dave Ramsey prefer term life insurance to other types of insurance because it’s

- Straightforward, so it’s easy to understand

- Affordable, costing as little as $15 a month

- Comprehensive, providing enough money to cover your family’s needs

For these reasons, term life insurance is the right financial product for a vast majority of life insurance shoppers.

How does term life insurance work?

The primary element of term life insurance that sets it apart from other types of life insurance is the term. Term periods usually last anywhere from 10 to 30 years, and you pay a monthly or annual premium during this time to keep the policy active. Once the term is up, you no longer pay the premiums and the policy expires.

The term length, premium amount, and death benefit are all outlined in the policy when you sign it. In general, the premiums are made more expensive by longer term lengths and larger death benefits; when the policy is active, the carrier may let you lower or raise the premiums by lowering or raising the term period or death benefit.

Some types of permanent life insurance, like whole life insurance, have an investment-like cash-valuecomponent. However, term life insurance does not, which also helps to keep the cost low. We’ll talk more about the differences between term and whole life insurance below.

How does term life insurance pay out?

Term life insurance pays out a death benefit if you die while the policy is in force. This is typically one tax-free lump sum payment or an annuity; however, it can also be paid out in installments, the balance of which can gain interest (although any gains are taxable).

There are some instances, such as those of fraud or suicide, during which your term life policy won’t pay out.

What happens if you outlive your term life insurance policy?

If you outlive your term life policy, the policy expires and you are no longer covered. You do have several options after that:

- If you still need life insurance coverage, you can purchase a new term life policy (at a higher cost than the original policy).

- If you still need life insurance coverage, you can convert your policy into a whole life policy.

- If you had a return-of-premium policy, the premiums you paid over the policy term will be refunded to you. See below for more on return-of-premium life insurance.

OUR EXPERIENCED AGENTS ARE AVAILABLE tO ASSIST WITH QUOTES AND ANSWER QUESTIONS

wE ARE HERE TO PROTECT YOU

- 85% 0f American consumers agree that they need insurance, yet 62% do not have any or not enough. We would like to bridge this gap.

- 83% of American consumers say they didn’t purchase life insurances because they thought it’s too expensive.

- 70% of US households with children under 18 would have trouble meeting living expenses after a sudden untimely death.

Our Agents are Waiting to Help you with your Coverage

Request a quote or Ask Questions

- 866.978.9477

- [email protected]